A caveat before I think out loud, quite possibly getting myself into a running battle I know I can’t win: I’m not a public market stock investor, I’ve never been one, and take the following ruminations at the price they’re offered: IE, free.

But this Alibaba stock debut doesn’t smell right to me, and it’s not the company- which is certainly a huge success story inside China, driven by a scrappy founder with a laudable (if manicured) personal narrative.

That said, Alibaba’s star turn smells of collective greed, with a hefty side of whistling past the graveyard.

I wouldn’t be writing this post if I didn’t have some knowledge around the deal, at least as it relates to the culture of access enjoyed by those with relationships to investment firms. I’ve missed a TON of great deals over my career, mainly due to my being a journalist (or acting like one, as it relates to holding stock) for a large percentage of my working life. But over the past few years I’ve carefully gotten into investing, mainly in early stage startups. I don’t look to invest in IPOs, but every so often, about twice a year, they get offered to me.

This is what happened with Alibaba. I was given the opportunity to – possibly – invest a small sum in Alibaba about a month ago. I figured it was a no-lose deal, so I said “sure” and I didn’t give it much more thought.

But as the IPO drew near, I reconsidered that decision. Not because I thought the stock was going to tank right after the IPO – I knew there was far too much money at stake, at least in the short term, for that to happen. No, I second guessed myself because I realized I honestly don’t understand the company, or the powers that control it. I pinged the fellow who had offered me the chance to invest, so as to recant my investment. But in the end, it didn’t matter. His fund didn’t end up getting an allocation of precious “at the open” stock anyway.

I can only imagine what it must have been like running that allocation, deciding who amongst all the wealthy, connected individuals and firms would get Alibaba stock at the opening price. It’d be like doling out rigged lottery tickets – everyone’s a winner! One thing I am sure of – it wasn’t a fair process, and I almost ended up benefitting from it by happenstance. So here’s why I am concerned about Alibaba, in no particular order:

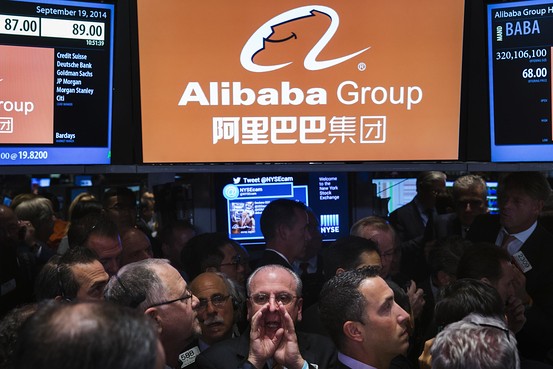

1. Greed. The company was considered, by everyone I’ve spoken to, a “sure bet” that would “pop at the open” just like the Internet stocks of old (and it did!). And yet, everyone that I have spoken with also believes that Alibaba is an offering that encourages the kind of negative Wall Street behavior none of us really want to see happen again. The book closed early. The stock priced above its initial range and moved up by nearly 40% on its first day of trading. Financial institutions, uncertain if they were going to get the allocations they wanted, started currying favor and hustling and pleading and whining. There was a frenzy of money making activity going on, and it felt like…pure greed. Alibaba is the ultimate insider’s stock – pedestrian retail investors did not get access to shares at the opening price, and most likely they will be the sheep to whom the wolves of Wall Street quickly sell (if they haven’t already). Insiders – wealthy people with access to early distribution of IPO shares at the open, have already made their fast buck. And the ultimate insiders have made a huge killing: a consortium of big banks poured $8 billion into Alibaba this June at a $50 price, a quid pro quo if ever there was one for giving a Chinese company access to the US markets. This kind of behavior adds questionable value to our society. I don’t doubt that everyone who held pre-IPO or at-the-IPO shares will make money, in fact, I’m sure of it. And that smells of a rigged game.

2. Shallow understanding. If you’re reading this, and you bought the stock at $93 (roughly the price of its first public trade, up from $68), tell me – have you ever used Alibaba’s services? Do you really understand the company? I doubt it, because Alibaba is a Chinese company. Most of us here in the US don’t speak Chinese, or have a reason to use Alibaba’s services. But for some reason we all seem willing to buy into the “Chinese eBay,” or the “Chinese Facebook,” as if throwing those successful public companies’ reputation over Alibaba’s frame somehow equates to quality. It’s a “bet on China,” as most of the press puts it. Certainly that sounds good, given the country’s growth and early stages, but it leads me to wonder… will most analysts who are covering the stock have done core due diligence on Alibaba – the kind where you go to the market in question and talk to customers, suppliers, and regulators? That would mean they have access and understanding of the culture that controls Alibaba, and I’m pretty sure that culture will not ever allow such diligence to occur (more on that below). What bankers and analysts will tell you is they’ve run the numbers that Alibaba has given them, and they are fantastic. Then again, so are the numbers on Chinese GDP growth – and most well informed people I’ve spoken to say those numbers are unreliable. (Oh, and by the way, if you think the $81 billion China just injected into its own economy was a shrug, I guess you should buy Alibaba without concern). Which leads to…

3. Controlled by a corrupt government. Do you know how China works? I don’t, but I’ve talked to enough folks who have lived and worked in China to get a pretty clear picture: The economic and government culture does not hew to US standards, to put it mildly. And like every other company in China, Alibaba is ultimately controlled by the whims of the Chinese government. It’s something of an open secret that Chinese corporate culture is definitionally corrupt by US standards. So…does listing it on the US stock markets change this fact? I could be wrong (see my caveat at the top), but I don’t believe it does. At least when companies are corrupt in the United States, we have a free and open press, and a democratic rule of law, to keep them in check. One could reasonably argue that it’s a supreme proof of our capitalist system that now Alibaba is public in the US, so it will now have to play by US regulations. I wish I could buy into that narrative, but I sense all we’ll really get is a company well versed at playing our game, rather than a company that is an active builder of value in our society and in other free markets.

Let me put this another way: Here are a list of Internet leaders who decided to forego China, because the government has made it nearly impossible for them to do business in the way that built our capital markets: eBay, Yelp, Twitter, Google, Facebook….and that’s just off the top of my head. So by buying into Alibaba, we’re buying into a system that has, through government fiat, denied innovative US companies growth in the world’s largest market, then capitalized that fiat into a stock it’s now selling back to us. Again, that just seems wrong.

4. Hazy growth outside core markets. Many observers are expecting Alibaba to come into the US and other large markets, and either buy or compete its way in, so as to fuel its long term growth. This I find to be difficult to believe, on many levels. Sure, Alibaba could try to buy…Yahoo!, Yelp, Twitter, hell, maybe even Box or Square or one of the other heavily funded “unicorns.” But…does anyone really believe it can *manage* those companies to success post transaction? To get a sense of how odd that sounds, imagine Google or Facebook buying a slate of Chinese companies and then managing them well. Sounds pretty risky to me.

Anyway, I’ve gone on long enough, and undoubtedly I’ve managed to piss off any number of friends and colleagues across multiple industries. So let me repeat: I’m no expert in Chinese markets, nor am I a professional public market stock investor. I’m just an industry observer, making industry observations. Caveat emptor.

Bang on comments on Alibaba. A total money grab. We already know the banks who ran this deal are greedy, but what can we say about the people who bought into it? Greedy *and* stupid?

While there’s much reasoning in your post to agree with, I did have a tough time swallowing the lil’ bit of vomit that came into my mouth when reading your comment, “At least when companies are corrupt in the United States, we have a free and open press, and a democratic rule of law, to keep them in check. One could reasonably argue that it’s a supreme proof of our capitalist system that now Alibaba is public in the US, so it will now have to play by US regulations.” Yeah, our “free and open press” is really good at telling the stories long after the fact, not so good during or even soon thereafter.

Did you live in the U.S. from 2004 through 2008, or 1998 through 2000? Never mind the days of Savings & Loan scandals. What’s the difference between a corrupt government and one that facilitates corrupt companies’ ability to operate with impunity? I find the transparency of the info that companies share with us in the U.S. as dim as anywhere else, though here this info provide this under the cover of light (if you know what I mean ;). The banking, insurance, technology, publishing and pharma industries have been caught in scandal after scandal, and any gov’t oversight has been cosmetic at best, where the revolving door between industry and gov’t is now all but accepted as an inevitable part of modern business life.

While I won’t argue that China has it’s issues around corrupt practices, let’s at least couch this around the fact that in the U.S. we’re in a similar boat. Where their balance of forces there appears to be gov’t supporting business, here we deal with business dictating to gov’t. It probably makes sense to maintain some humility when discussing different economic systems lest we be viewed as throwing stones 😉

Well if you feel the need to “appear as if you’re not casting stones” then more power to you.

As someone who has actually done business in China for a long time, I can tell you its *not* “like the US”

The only people drawing the “hey, we’re bad too!” false equivalency haven’t done business there. Full stop.

This isn’t some social commentary or political correctness/sensitivity discussion. It’s business plain and simple.

The fact is that business in China is *massively* corrupt, exclusionary to foreigners, high risk and extremely complex.

Doesn’t mean you can’t make money, but if you think dealing with Alibaba in China is no different than dealing with Google in Mountainview then you’re delusional.

You sound bitter that you couldn’t get in.

Totally fair point Karen. In fact I’m not. I didn’t consider that before. But that’s not what motivates me (making money on a quick turn). In fact, the idea I might was a motivator to write this. And I’m rather relieved I didn’t end up profiting.

John, your look at Alibaba was refreshingly hype-free and without Wall Street hysteria. Thank you for a thoughtful look at a bubble just waiting to burst.

It’s like predicting the future though. Who knows? I mean, even factoring in sovereign risk etc some analysts still see an upside. They think it’s worth the risk. Have a look at this coverage for a different angle:

In short: US$327b in sales at 45% growth for BABA.

Boy, so many things to say but briefly some counter points:

a. Wall Street investment firms are global – just ask the Greeks about getting screwed by Goldman Sachs. The investment banks would have worked with Alibaba and the Chinese authorities to *guide* it through the IPO.

b. Wasn’t there a problem with Facebook’s IPO? Post-Snowden, what is to say that US Government agencies colluded with both Wall Street (and possibly indirectly with Facebook) to make sure the IPO was a success. Facebook is a lot more valuable for *data mining* than Google search data.

c. Isn’t Baidu (another Chinese company in the search space) listed on Nasdaq that is doing incredibly well.

d. Wall Street investment banks are the drivers of IPO’s and their success. Your critique should have been aimed squarely at them as they are driven by how much money they are going to make at the IPO-pop and whose buy-in they need and what the buy-off will be. They don’t give a rat’s ass where the deal is sourced from – the USA, UK, China, Russia and so on.

e. The last figures I saw, there has been a massive transfer of stock ownership to the top 1% in the last 10 years. The middle classes – many of whom got screwed by the financial crisis – no longer owns or trades stock like they did at the height of the dot.com era and so Alibaba will not affect them. But, it will make the 1% more wealthier.

f. The *real* story here is that the Chinese software companies are coming. For decades the view was that the Chinese (and South East Asians excepting Indians) were great at hardware but lousy at software as they were primarily copy-cats and not creative. Well, they now have the manufacturing skills to make the iPhone and to build world-class software. And, that is what people in Western countries should be fearful about.

Yes, there are a number of Chinese companies listed, you are right, I think the size of this just took it to another level. Thanks for adding value here in comments, appreciate it.

I think you’re spot on. Any guy that used the word “trust” as many times as Ma did on Friday as he vaulted from CNBC to FOX to Bloomberg should have gotten anyone’s guard hairs up. As he kept waving his thumbs in the air throughout the day, I kept thinking -is the thumb the Chinese translation for the third finger?

So you claim to be a journalist yet this article comes off as very Fox Newsy to me. Give us some facts not conspiracy theory.

This is opinion, and it’s not – for the most part – about the company’s services. It is about the behavior of financial institutions and the culture of wealth in the US around the offering, and it’s also about the assumptions around growth and knowledge of operating climate in China. Which I admit again, I don’t know much about, but what I’ve been told by reputable sources is as I described it. However, totally open to being proven wrong.

Great read… From someone who covered the Chinese market for a large tech firm I thoroughly agree with points 2-4.

1: Successful growth outside that market is HIGHLY questionable.

2: Supposedly Mr. Ma’s company is less exposed to government control than state owned enterprises that dominate the landscape… but that view could easily be manufactured. Hard to believe anyone in the Chinese market gets to that scale without some backing.

3: Any data out of China is highly suspect and often does not correlate with more reliable sources such as trade data.

At any rate, I have been explaining this to folks who ask, and it’s refreshing to see a similar view finally… as far as risk goes this company is about as exposed as you can be.

Welcome to the stock market pal. You’re essentially betting on the credit card debt of companies here in the stock market except without the high interest. If that doesn’t strike you as greedy, corrupt and hazy in the first place, I don’t know what does.

This reminds me of the kind of articles that appeared after the Facebook IPO. Mostly negative, bearish, and distancing themselves from what they thought would be a sheer loser and scam.

Anyone check the Facebook stock price lately? $38 at IPO, $77.81 today. Too bad for all of the suckers that bought into THAT nonsense.

Thanks John for this refreshing and thought-provoking take. It’s always tempting to kick oneself for missing an opportunity to make a quick buck. But ethics have to start somewhere and in this case you definitely did the right thing.

If a piece of privacy-stealing DAU-overstating rubbish of a platform can trade at > 75

What’s everyone’s beef with an ACTUAL trade/revenue driven company had a great valuation!?

It’s November 11, Alibaba is trading at $115 and I’m here because something just doesn’t smell right to me. You have a foreign company, who couldn’t get a listing on the Hong Kong exchange because of corporate governance issues, whose books could not be audited by US accountants and that who has survived and thrived under a regime where corruption and bribery is the norm. Oh and whose holding company is a shell in the Cayman islands.

This is the Wall Street’s Darling? Reminds me of when these guys characterized income verification as something uptight people were doing to hold the housing market hostage.